Get the free it 2105 form

Show details

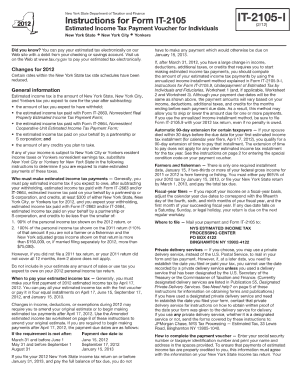

Visit us on the Web at www. tax. ny. gov to pay your estimated tax electronically. For assistance see Form IT 2105 I Instructions for Form IT 2105 Estimated Tax Payment Voucher for Individuals. Enter applicable amount s and total payment in the boxes to the right. Print your social security number or taxpayer identification number and 2015 IT 2105 on your payment. Telephone assistance Automated income tax refund status 518 457-5149 Personal Incom...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it 2105 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 2105 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it 2105 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit it2105 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out it 2105 form

How to fill out form 2105:

01

Begin by entering your personal information, such as your name, address, and social security number, in the designated fields.

02

Next, provide details about your employer, including their name and address, as well as the dates of your employment.

03

Fill in the expenses section, indicating any allowable job-related expenses you incurred during the tax year.

04

Calculate the total amount of your job-related expenses and enter it in the appropriate box.

05

If you were reimbursed for any expenses by your employer, disclose the amount in the corresponding box.

06

Subtract the reimbursement amount from your total expenses and enter the result in the appropriate box.

07

If you had more than one employer during the tax year, attach additional Form 2105 to report the expenses for each employer separately.

08

Review the completed form to ensure accuracy and completeness, and sign and date it before submitting it with your tax return.

Who needs form 2105:

01

Employees who have unreimbursed job-related expenses may need to fill out Form 2105.

02

Self-employed individuals or independent contractors who have deductible business expenses should also use this form to report their expenses.

03

Individuals who work from home and have qualifying home office expenses may also be required to complete Form 2105.

Please note that the information provided is a general guide and may vary depending on your specific circumstances. It is always recommended to consult with a tax professional or refer to the official instructions provided by the IRS when completing tax forms.

Fill nys it 2105 fillable : Try Risk Free

People Also Ask about it 2105

Do you get a form for estimated tax payments?

What happens if you miss estimated tax deadline?

How do I get an IRS payment voucher?

Can I make estimated tax payments without a voucher?

Are IRS estimated tax payments mandatory?

Can I choose not to pay estimated taxes?

How do I claim credit for estimated tax payments?

Are estimated tax payments deductible?

What is NY IT 2105?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is it 2105?

It appears that "it 2105" may refer to a tax form in the United States. Form IT-2105 is used for estimated tax payments in New York State. It is used by individuals to calculate and pay their estimated tax liability throughout the year.

Who is required to file it 2105?

Form 2105 is used by employees to deduct certain job-related expenses that were not reimbursed by their employer. Employees who have work-related expenses that exceed 2% of their adjusted gross income (AGI) may be eligible to file Form 2105 and claim those expenses as deductions on their federal income tax return.

How to fill out it 2105?

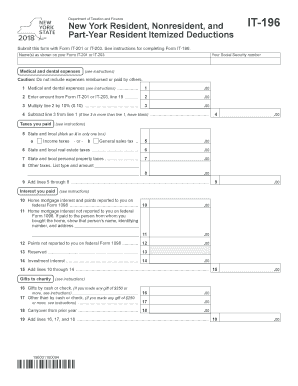

To fill out form 2105, follow these steps:

1. Start by entering your name, Social Security number, and address at the top of the form.

2. In Part I, provide information about your employer, including their name, address, and Employer Identification Number (EIN). Indicate the type of employer and the dates of your employment.

3. In Part II, report your business expenses that were not reimbursed by your employer. This includes expenses related to travel, meals and entertainment, transportation, and other miscellaneous expenses. Fill in the appropriate boxes for each category, providing a detailed description and the amount spent.

4. Part III is to be completed if you are claiming expenses for a home office or the use of your car for business purposes. Follow the instructions provided to calculate and report these expenses.

5. In Part IV, you need to calculate and report your meals and entertainment expenses. Use the provided worksheet to record your expenses and determine the amount to be claimed.

6. Part V is for reporting your travel expenses. Enter the dates and locations of your business trips and provide a breakdown of your expenses, including transportation, lodging, and meals.

7. Provide any additional information or explanations in Part VI, if required.

8. Calculate the total amount of your business expenses and transfer it to Line 10 on Form 2105.

9. If you had any expenses that were partially reimbursed by your employer, subtract the reimbursed amount and enter the difference on Line 11.

10. You may need to complete Schedule A if you are claiming any expenses for work in a designated disaster area.

11. Sign and date the bottom of the form.

Remember to keep copies of all receipts and supporting documentation for your business expenses in case of an audit.

What information must be reported on it 2105?

IT-2105 is a form used for estimating tax liability and determining the appropriate amount of income tax withholding for New York State and City personal income tax purposes. It must be completed by individuals who have income from sources other than wages subject to withholding or who anticipate not having enough tax withheld from their wages to cover their tax liability.

The information that must be reported on IT-2105 includes:

1. Personal information: This includes your name, address, Social Security number, and filing status (single, married filing jointly, head of household, etc.).

2. Estimate of income: You must provide an estimate of your total income for the year, including wages, interest, dividends, self-employment income, rental income, etc.

3. Estimated tax credits: If you qualify for any tax credits, such as the Earned Income Credit or Child and Dependent Care Credit, you must provide the estimated amounts.

4. Estimated tax payments: If you have already made or anticipate making estimated tax payments throughout the year, you must report these amounts.

5. Deductions and exemptions: You may need to provide information about deductions and exemptions you plan to claim, such as deductions for student loan interest or exemptions for dependents.

6. Other relevant information: Depending on your specific situation, you may need to report additional information, such as estimated capital gains or losses, estimated out-of-state income, or estimated credits from other states.

It's important to note that the information reported on IT-2105 is used for estimating purposes only and may change when you file your actual tax return. It is recommended to consult with a tax professional or refer to the instructions provided with the form for more detailed guidance.

When is the deadline to file it 2105 in 2023?

The deadline to file Form 1040 for tax year 2022 (not Form IT-2105) is typically April 15, 2023. However, this date may vary slightly depending on weekends or holidays.

What is the penalty for the late filing of it 2105?

The penalty for late filing of Form 2105, also known as the Employee Business Expenses form, can vary depending on the circumstances. However, as of 2021, the penalty for late filing or failure to file Form 2105 is generally $330 per form for each individual taxpayer. This penalty amount is subject to change and it is always advisable to consult the latest IRS guidelines or seek professional advice for specific information related to your situation.

Can I create an electronic signature for the it 2105 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your it2105 form in minutes.

Can I create an eSignature for the form it 2105 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your it 2105 instructions and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete what is form it 2105 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your nys it2105 form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your it 2105 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form It 2105 is not the form you're looking for?Search for another form here.

Keywords relevant to it 2105 2023 form

Related to ny it 2105

If you believe that this page should be taken down, please follow our DMCA take down process

here

.