Get the free it 2105

Show details

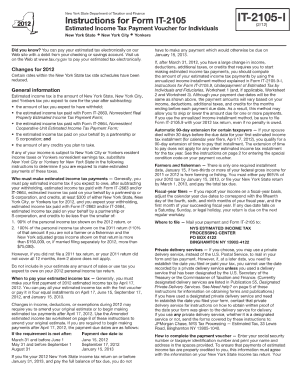

Visit us on the Web at www. tax. ny. gov to pay your estimated tax electronically. For assistance see Form IT 2105 I Instructions for Form IT 2105 Estimated Tax Payment Voucher for Individuals. Enter applicable amount s and total payment in the boxes to the right. Print your social security number or taxpayer identification number and 2015 IT 2105 on your payment. Telephone assistance Automated income tax refund status 518 457-5149 Personal Incom...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form it 2105

Edit your it2105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 2105 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nys it 2105 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit it 2105 instructions form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ny it 2105 form

How to fill out form 2105:

01

Begin by entering your personal information, such as your name, address, and social security number, in the designated fields.

02

Next, provide details about your employer, including their name and address, as well as the dates of your employment.

03

Fill in the expenses section, indicating any allowable job-related expenses you incurred during the tax year.

04

Calculate the total amount of your job-related expenses and enter it in the appropriate box.

05

If you were reimbursed for any expenses by your employer, disclose the amount in the corresponding box.

06

Subtract the reimbursement amount from your total expenses and enter the result in the appropriate box.

07

If you had more than one employer during the tax year, attach additional Form 2105 to report the expenses for each employer separately.

08

Review the completed form to ensure accuracy and completeness, and sign and date it before submitting it with your tax return.

Who needs form 2105:

01

Employees who have unreimbursed job-related expenses may need to fill out Form 2105.

02

Self-employed individuals or independent contractors who have deductible business expenses should also use this form to report their expenses.

03

Individuals who work from home and have qualifying home office expenses may also be required to complete Form 2105.

Please note that the information provided is a general guide and may vary depending on your specific circumstances. It is always recommended to consult with a tax professional or refer to the official instructions provided by the IRS when completing tax forms.

Fill

it2105 form

: Try Risk Free

People Also Ask about please note that the information provided is by the irs when completing tax forms

Do you get a form for estimated tax payments?

Use Form 1040-ES to figure and pay your estimated tax. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.).

What happens if you miss estimated tax deadline?

If you don't pay enough tax through withholding and estimated tax payments, you may be charged a penalty. You also may be charged a penalty if your estimated tax payments are late, even if you are due a refund when you file your tax return.

How do I get an IRS payment voucher?

Where do I get a payment voucher? You can get the form by calling the tax forms number, 800-829-3676. You can also pick one up at your local IRS office. Call them first, 800-829-1040, to make sure that the form is available and to check on hours of service.

Can I make estimated tax payments without a voucher?

To avoid penalties, the payment—by check or money order accompanied by the correct IRS voucher—must be postmarked by the due date. Or, online payments can be made without a voucher.

Are IRS estimated tax payments mandatory?

Generally, you must make estimated tax payments for the current tax year if both of the following apply: You expect to owe at least $1,000 in tax for the current tax year after subtracting your withholding and refundable credits.

Can I choose not to pay estimated taxes?

If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

How do I claim credit for estimated tax payments?

Answer: Report all your estimated tax payments on Form 1040, line 26. Also include any overpayment that you elected to credit from your prior year tax return.

Are estimated tax payments deductible?

You can deduct any estimated taxes paid to state or local governments and any prior year's state or local income tax as long as they were paid during the tax year. Generally, you can take either a deduction or a tax credit for foreign income taxes, but not for taxes paid on income that is excluded from U.S. tax.

What is NY IT 2105?

Form IT-2105, Estimated Tax Payment Voucher for Individuals.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 2105 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your it 2105 form 2025 in minutes.

Can I create an eSignature for the nys estimated tax form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your nys estimated tax payment voucher and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete nys estimated tax payment form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your 2025 top tax bracket, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is it2105?

IT-2105 is a form used in New York for requesting a payment installment agreement for income taxes.

Who is required to file it2105?

Any individual or business that owes New York State income tax and wants to request an installment payment plan must file IT-2105.

How to fill out it2105?

To fill out IT-2105, provide your personal information, the amount of tax owed, and details regarding your proposed payment plan.

What is the purpose of it2105?

The purpose of IT-2105 is to allow taxpayers to request an installment agreement to pay their New York State income tax liabilities over time.

What information must be reported on it2105?

IT-2105 requires reporting your name, address, Social Security number, the amount owed, and proposed payment terms.

Fill out your it 2105 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nys Estimated Tax Vouchers is not the form you're looking for?Search for another form here.

Keywords relevant to nys estimated income tax form

Related to 2105 2025

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.